Share of wallet (SOW) is one of the best indicators of loyalty. It provides a great way to objectively evaluate how well your cross-selling and customer retention strategies are working.

In this post, we'll explore not only how SOW is measured in banking, but how it can be increased.

Defining SOW in banking

SOW tells us the proportion a product or service occupies within a client’s wider budget for a particular category.

While customer satisfaction and Net Promoter Scores help measure loyalty, SOW reveals the extent to which it’s being translated into tangible results.

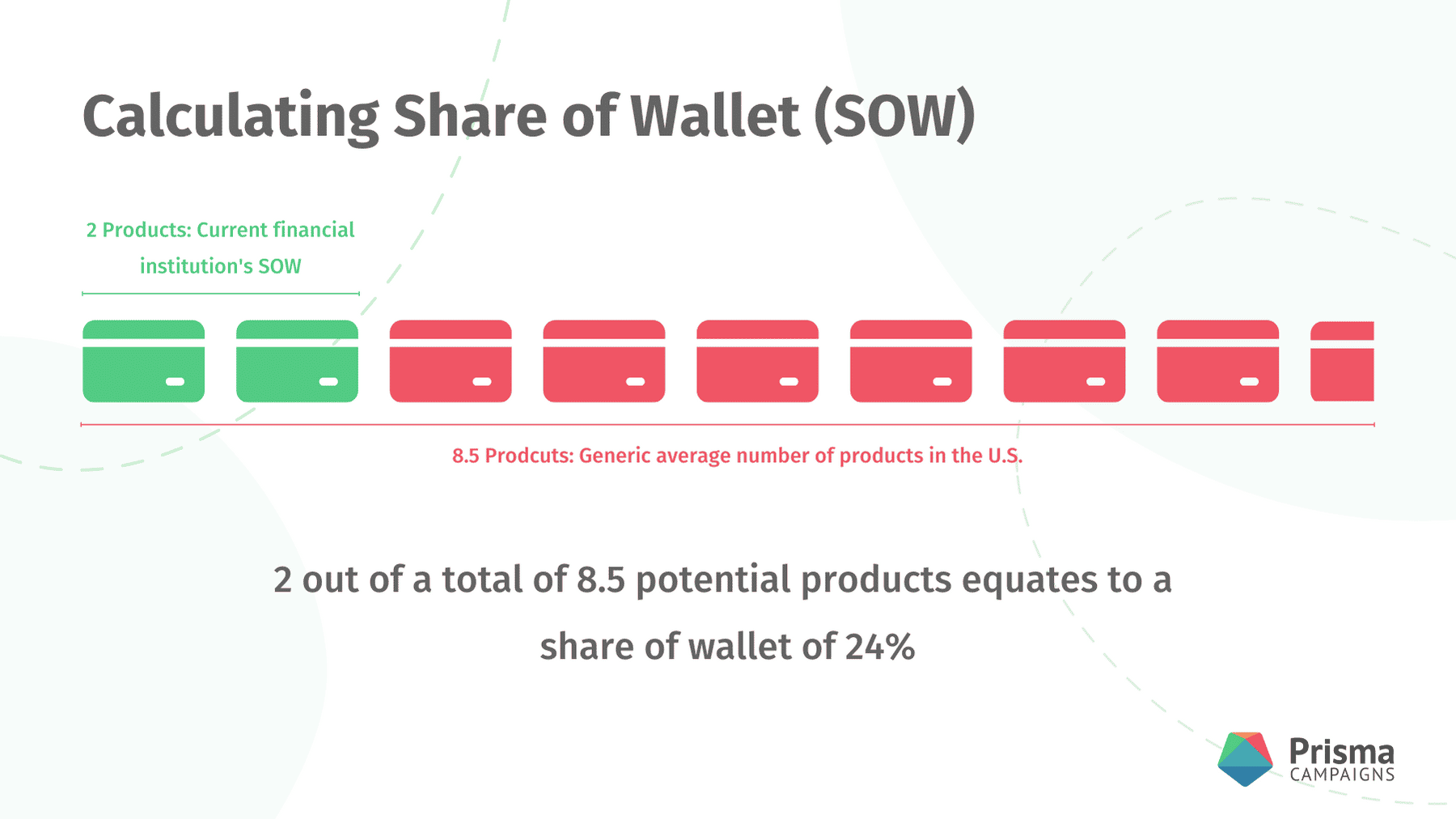

A straightforward way to calculate SOW is to use the generic average number of products, which in the U.S. is 8.5, excluding investments. If your customer has an auto loan and a savings account with you (i.e., two products), your share of wallet is 24% (two out of a total of 8.5). If you successfully sign them up for a third product, say a checking account, SOW will increase to 35% (three out of a total of 8.5).

For individuals, using an average has its limitations. A 45-year-old in their prime borrowing years will likely hold more products than the average client. As a result, their share can end up overstated. On the other hand, their kids probably have fewer products than the average client, leading to an understated SOW. Ultimately, assuming an average number of products per client works best at the institutional level, not at the individual level.

To increase share of wallet you must become the Primary Financial Institution.

The advisory firm RFI Group authored one of the most comprehensive studies on SOW in banking. After surveying more than 40,000 consumers through 21 markets, it concluded that "in order to create a fertile field for cross-selling and therefore increased SOW, one must become the Primary Financial Institution (PFI)."

There are four main factors that drive PFI status:

- Frequent use: PFI is the institution with which the customer transacts more frequently; more interactions, activities, and engagement.

- Recurring payments: customers use the institution to pay their monthly bills, preferably using automatic payments.

- Brick & Mortar: customers still value physical channels, even if they don't use them regularly. Branch convenience ranks as the most critical reason a customer chooses a bank.

- Loyalty / Longevity: customers tend to identify the institution they are using the longest as their PFI. Effective retention strategies, like sticky rewards programs, are critical.

Using technology to increase SOW

The role of technology cannot be overstated. A significant portion of today’s interactions take place in digital channels.

In 2020, 46% of organizations provided consumers with the option to open a checking account end-to-end via their mobile device, up from 36% the year prior. When looking at website end-to-end account opening more broadly, these numbers are even higher.

75% of firms surveyed in the MeridianLink Digital Banking Report listed digital banking transformation as a priority moving into 2021 and beyond. The takeaway? Web and mobile solutions are rapidly becoming table stakes in the industry.

Financial institutions in a post-COVID world

The global pandemic has only accelerated the desire for consumers to interact with their banks and credit unions via digital platforms. Coupled with this consumer behavior change is the desire to have products and services delivered efficiently.

Consumers want digital solutions, and they want them delivered quickly and painlessly.

Despite this demand, many institutions aren’t implementing the required technological solutions. Outdated and cumbersome systems continue to persist despite substantial improvements in digital offerings.

And it’s not just young, tech savvy clients wishing to adopt these digital services. The pandemic has driven adoption of these solutions among consumers of all ages.

A closer look at the back office

Behind the scenes, technology can improve non-digital experiences as well.

Working closely with dozens of banks and credit unions, we identified three critical activities that help improve SOW:

- Using your data for insights and targeting.

- Leveraging your digital channels for targeted cross-selling.

- Ensuring automated messages feel personalized and relevant.

At the core of these capabilities is a marketing automation platform that can act as the "middle-man." The platform connects data on one side with digital channels on the other. Data from any source can be pulled, segmented, and subsequently used to customize centrally managed campaigns. The messages can then be pushed out in a coordinated fashion through various channels.

Learn more about how marketing automation can increase your SOW

The Prisma Campaigns marketing platform has been specially designed for financial institutions. We help institutions grow their SOW with data-driven, cross-selling campaigns in their digital channels. Click here to learn more and schedule a demo.

The roadmap to personalization in banking

An exclusive report by Ron Shevlin

Image credits: Shutterstock & Prisma Campaigns